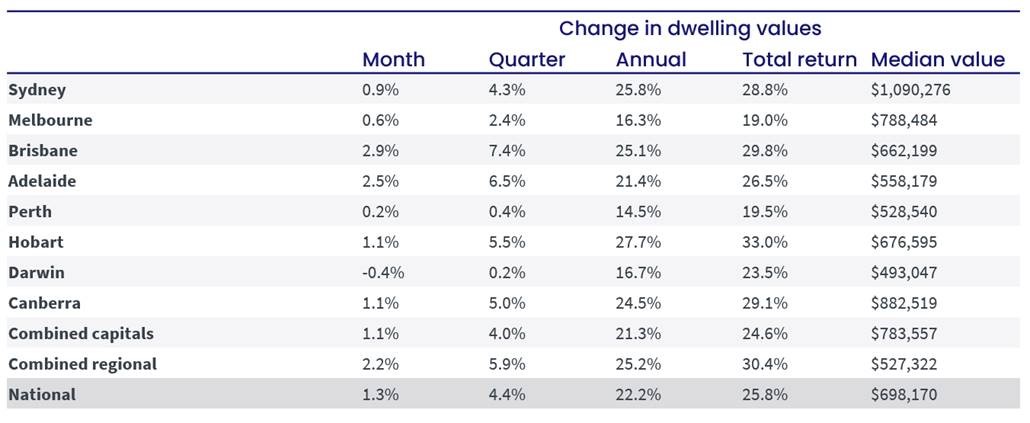

CoreLogic’s November property market analysis saw house values rise 1.3 per cent for the month – the 14th consecutive monthly rise – for an annual rise of 22 per cent. That means the median value of an Australian house has risen $126,000 in a year.

That’s a $126,000 increase in the equity in your property, which means a $126,000 increase in your net wealth. I’ve written here on how to best use this lift in equity in your property.

While all this is great, there are a few points to make:

The November rise in values is the lowest since January

So while values are still growing, it’s at a slower pace.

Virtually every factor that has driven the housing boom are now turning against it: fixed mortgage rates are rising; higher listings are taking some urgency away from buyers; affordability has become a bigger barrier because loans are harder to get.

Brisbane and Adelaide markets playing catch-up

The Brisbane and Adelaide markets showed the strongest monthly growth of 2.9 and 2.3 per cent respectively. This is because they haven’t seen the big increase in listing numbers of the other capital cities.

Houses are driving the increase

Houses have continued to outperform home units, with capital city values up 1.2 per cent and 0.7 per cent respectively over the month. However, the quarterly rate of growth is now the narrowest it has been since October last year. Read on for what that means for home units.

Home units do look like property bargains

I analysed Louis Christopher’s 2022 Boom Bust property report which, among a whole range of great recommendations, predicted home units may be a better investment opportunity than houses next year.

It pointed that the boom in houses values had been way greater than in home units, which would likely catch up.

According to CoreLogic capital city houses are now 37.9 per cent more expensive than capital city home units – the largest difference on record. In dollar value terms, a capital city house is averaging approximately $240,500 more than a capital city unit. In Sydney, where the gap between house and unit values is the widest, a house costs $523,000 more on average than a unit.

Keep reading: Our two-speed property market: are the bargains in home units?

Yes, fixed rate home loans keep rising

A lot of the increase in property prices has to do with the low interest rates we’ve been enjoying. However, it’s important to understand that while the Reserve Bank isn’t lifting the official interest rate, the banks are. And it’s important to shop around.

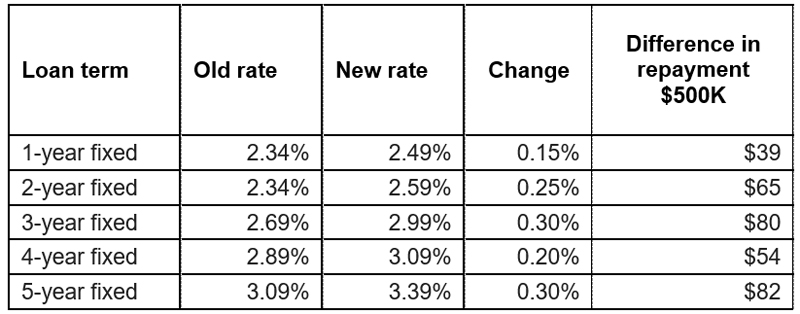

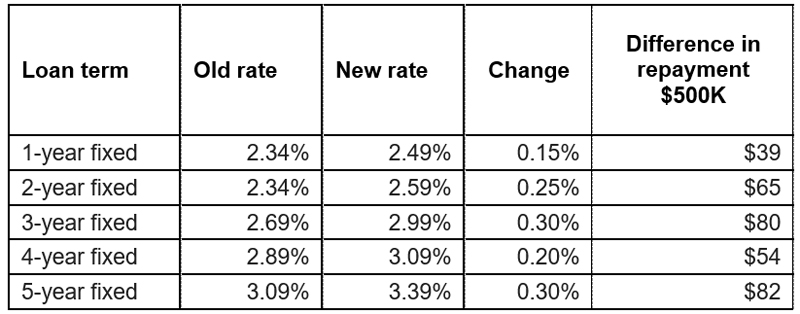

For example, Australia’s largest bank, CBA, has hiked fixed rates for the third time in six weeks.

CBA increased its owner-occupier fixed rates by up to 0.30 per cent, while investor fixed rates rose by up to 0.60 per cent.

CBA hikes for owner-occupiers paying principal & interest

Source: RateCity.com.au. Note: Above rates are for owner-occupiers paying principal and interest on a package rate with an annual fee of $395. Monthly repayments are based on a $500K, 30-year loan over the fixed rate term.

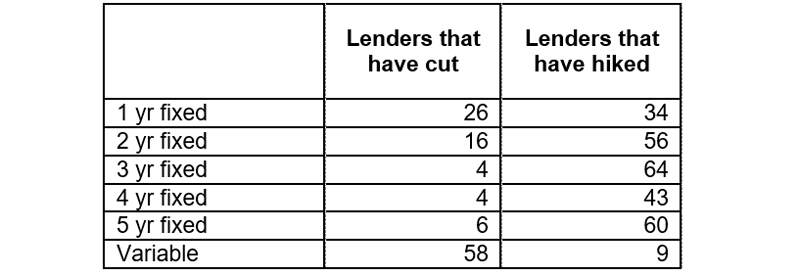

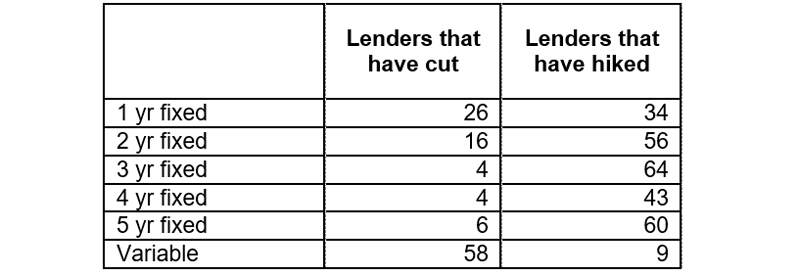

Lenders that have moved at least one rate in the last month – 27 Oct to 26 Nov 2021

Source: RateCity.com.au. Note, some lenders may have moved more than one rate.

The cost of fixed-term funding continues to rise

RateCity research director, Sally Tindall, says:

“It’s raining rate hikes and the storm is nowhere near over. The flood of fixed rate hikes is likely to keep going as the cost of fixed-term funding continues to rise.

“The number of fixed rates under 2 per cent is dropping rapidly. Six months ago, there were 161 fixed rates under 2 per cent. Today there are just 87 and we expect this number to keep plummeting.

“NAB is the only big four bank with a rate starting with a ‘1’ – its 1-year fixed rate – however this is likely to rise in the next round of the bank’s rate hikes.

“While there are still a decent range of short-term fixed rates under 2 per cent, there are now just three 3-year fixed rates under this mark and no 4- or 5- year rates starting with a ‘1’.

“Surprisingly, Greater Bank is still offering the lowest fixed rate in our records at 1.59 per cent for up to two years, however, this record-low rate is unlikely to see the year out.”

Trending

Sorry. No data so far.