NAB has launched of its new Buy Now, Pay Later (BNPL) product, NAB Now Pay Later, with NAB customers now able to pre-register for early access to the service.

Unlike some other BNPL products, NAB’s offering has no late fees, no interest and no account fees. This makes it a potentially cost effective option when compared to other major BNPL providers such as Afterpay and CommBank’s StepPay.

NAB customers will be able to access up to $1,000, split purchases into four payments and use the service anywhere Visa is accepted, including supermarkets and petrol stations. This will likely make it an appealing option for consumers, as living costs continue to climb at a faster rate to wages and budgets feel the strain.

How does NAP now pay later compare?

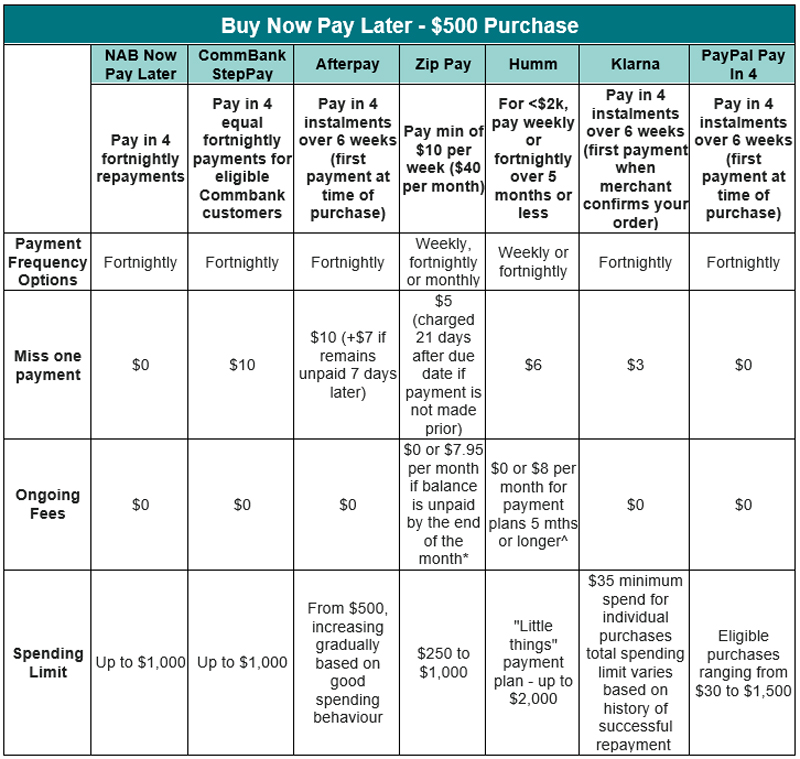

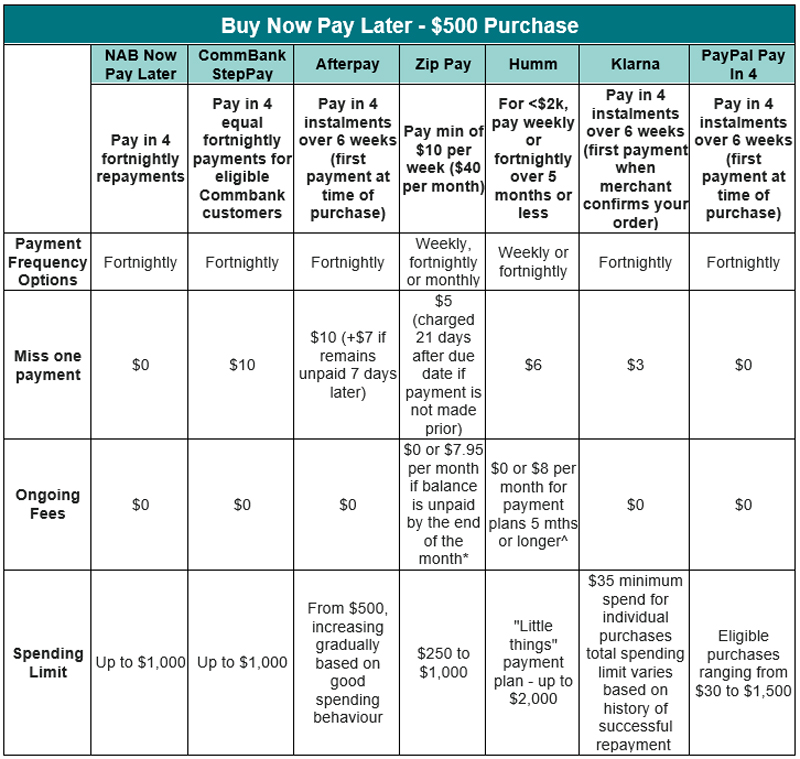

To find out how NAB Now Pay Later compares to other major BNPL players Canstar analysed the costs associated with making a $500 purchase, as well as the cost of missing a payment on a $150 purchase.

Analysis from Canstar shows that along with PayPal Pay in 4, NAB Now Pay Later is the only BNPL service that doesn’t charge late fees, making it a cost effective option alongside its competitors.

Both Afterpay and CommBank’s StepPay charge late payment fees of $10 for the first missed instalment, while ZipPay, Humm and Klarna also charge late payment fees of $6 or less.

Source: www.canstar.com.au. Prepared on 26/05/2022. Fees and/or payment terms based on a single purchase amounting to $500. *Balance due for that month is for purchases made in the preceding month. ^Only a single monthly fee will be charged regardless of the number of active payment plans. See providers for full details on eligibility, terms and conditions.

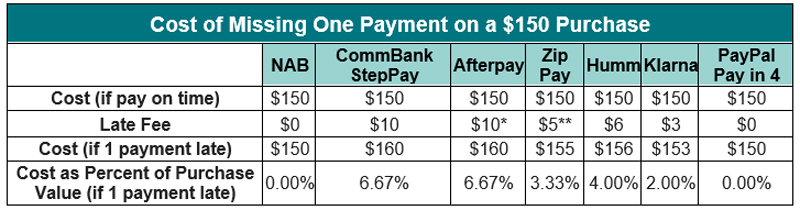

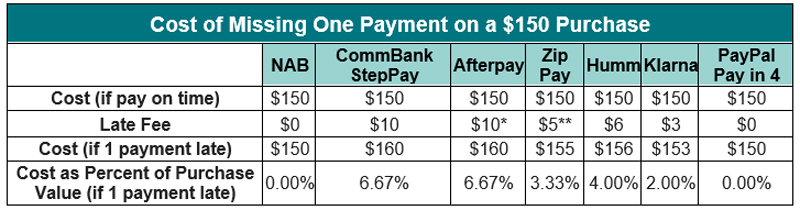

Cost of missing one payment on a $150 purchase

When looking at the cost of missing one $150 payment across several BNPL providers, analysis from Canstar shows NAB Now Pay Later and PayPal Pay in 4 customers would pay $0 in fees, making both of these services the most cost effective options.

Both Afterpay and CommBank’s StepPay customers would pay the highest percentage in fees, totalling 6.67 per cent of the original purchase value after the first missed payment.

Source: www.canstar.com.au. Details correct as of 25/05/2022. Late fees based on a purchase amount of $150. *An additional $7 applies if payment remains unpaid 7 days after due date. **Given 21 days to make payment before fee is charged. ‘Cost if one payment late’ includes a single charge of one late payment fee and does not include any ongoing fees that may be applicable. See providers for full details on eligibility, terms and conditions.

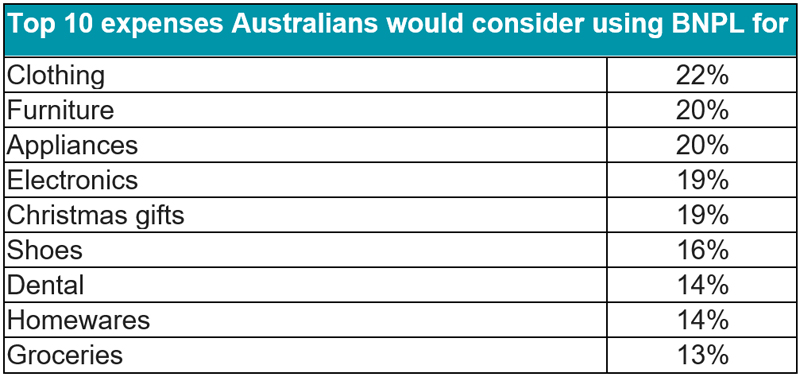

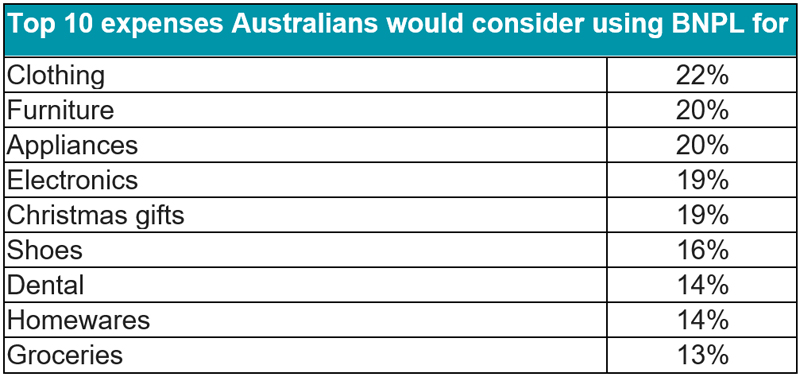

Top 10 expenses Australians are most likely to use BNPL for

As a matter of interest, here’s what Aussies are buying using BNPL. The dental work is certainly interesting!

Remember, many people will happily use BNPL services NAB Now Pay Later without issue for years. They’re the people who can afford to pay for an item outright, but shrewdly choose to delay payment since it’s offered. Why hand over your money to someone else when you can keep it in your own pocket for a bit longer?

However, Financial Counselling Australia (FCA) believe that BNPL is causing harm and needs better safeguards. That’s because they are seeing a sharp increase in people presenting to their services due to carrying a BNPL debt they simply can’t repay.

How to avoid the BPNL trap

The simplest way is to not use BPNL services. Pay upfront for what you need.

Of course, that’s easy to say, harder to do. If you can’t resist the allure of purchasing something now that you can’t afford until later, at least be sensible about it.

1. Don’t buy what you can’t afford

BNPL may be wrapped up in shiny ‘convenient payment plan’ sheep’s clothing, but it’s still the big, bad debt wolf.

Credit, any kind of credit, is not an instant ticket to a higher pay packet. You earn what you earn; you can afford what you can afford. If you’re not prepared to budget and save to get the things you want in life, don’t buy them.

If you’re still tempted to get on the BNPL train, read on.

2. Only use one BNPL account

Don’t be tempted to open an NAB Now Pay Later, Afterpay, Zip Pay, Brighte, Klarna, Openpay, Payright… you get the idea… account. Just have one on the go because having multiple accounts can make it really difficult to manage your repayments. Unless you’re really disciplined, it’s also far too easy to rack up debt if you can’t see the total amount in one place.

Plus, you’ll be paying more monthly account keeping fees than necessary. You can find out what those fees are for each BNPL service here.

3. Stick to a limit

Set yourself a ceiling on the amount you can owe via BNPL. Note that it will probably be a much lower amount than the BNPL service is prepared to offer you.

4. BNPL one thing at a time

Most BNPL services will charge you a fixed ‘monthly account keeping fee’ while you owe them money. It can be tempting to put more purchases onto your account to ‘get your money’s worth’, but that makes even less sense than racking up an extra $50 in purchases to avoid paying a $10 delivery fee (we’ve all done it).

BNPL debt is still debt. So buy one thing at a time, paying the debt off in full before committing to something new.

5. Don’t use credit to pay your BNPL instalments

Afterpay will charge you $10 each time you are late with a payment (check the terms for other BNPL services). While $10 doesn’t sound like a lot, it sure adds to the price of the $50 ‘on sale’ pair of jeans you bought on Afterpay. Incurring late fees can also wreck your credit score. Not to mention how quickly those $10 add up if (a) you are late paying more than one Afterpay purchase each month and/or (b) you are late paying more than one payment.

A huge BNPL trap is using credit to pay your BNPL account to avoid the late fees. While Afterpay and other BNPL services don’t charge interest, your credit card company sure does.

Remember, if you can’t make your BNPL repayment, you’re unlikely to make your credit card repayments either. With the average credit card interest rate hovering at a whopping 19.94 per cent, believe me, your credit card is not your ‘get out of jail free’ card.

6. Set up automatic payments

If you set up automatic payments, you won’t be tempted to skip a payment and start racking up fees.

On Afterpay, that’s as simple as entering the details of your preferred payment card under “Add a payment method” in the “Billings” section of “My Account”. When you have an instalment due, they will notify you beforehand so you can make sure you have enough in your account to pay. You can also enter a ‘back up’ credit card that the payment will default to if there is not enough in your primary account.

Note as per above, be very careful of using a credit to pay your BNPL instalments. Make sure the card you’re using to pay is a debit card, not credit.

7. Seek help if you need it

If you feel like you’re already caught in the BNPL trap, seek help.

National Debt Hotline: 1800 007 007

Trending

Sorry. No data so far.