Managing money in your 30s means getting your financial foundations sorted and beginning to invest for your future.

Many people say that their 30s are the best years of their life, and we hope that’s 100 per cent true with regards to your money too!

With a bit of common sense and a heap of careful planning, that will absolutely be true. Here are our top tips for managing money in your 30s. Just remember to consider your own personal circumstance with these tips – adapt to suit your situation.

1. Millennial, know thyself

Make sure you’re doing what you want to be doing. Ask yourself some key questions to get to the heart of what you actually want your money to do for you:

- Are you happy with where you are at in life?

- Do you love your career/business?

- What are you loving about life, and what is hard?

- Are you confident in who you are and where you want to be?

The rest of your money strategy will sail so much smoother if you’ve figured out who you are and where you’re going. (Pro tip: It’s especially helpful if you can figure this out pre-kids! Trust us, life gets a lot busier once they hit the scene.)

Set aside a day to dream. Have a brainstorm and reflection day where you vomit onto paper your life aspirations and goals. Don’t be embarrassed – own it! It’s your life, so live it.

Incidentally, if you’re struggling with mental health issues, have a chat with your GP. It’s totally ok to be facing some mental health challenges. Many people do. So don’t be ashamed and don’t hesitate to seek support.

2. Keep reassessing your priorities

Keep refining your life strategy, and prioritise your money goals accordingly.

Ten years is a long time and so much can change. What you wanted at age 21 is probably completely different now that you’re 31. Keep checking in with yourself, your partner or your family and make sure you know what you’re aiming for.

What’s your goal and strategy to achieve that goal? Allocate your money to suit. Get your ducks in a row and start making steps towards your dreams!

3. Get your debt under control

Now is the time to get your money under control and pay off your debts.

Good strategies here: Six ways to manage mounting debt

What were your 20s like financially? A little loose maybe? Don’t stress. Start getting back on track by checking that your money management system is working. Don’t feel embarrassed, don’t feel stupid – just bring it all out in the open and use past experiences to learn. Check out the Glen James Spending Plan if you’re looking for somewhere to start.

Ask these questions as you audit your expenses:

- What’s my income every week/fortnight/month?

- What are my expenses compared to this income? Do the numbers line up?

- If not, can I either increase my income, or decrease my expenses?

- Which expenses can be cut?

Read this too: 10 killer budgeting strategies

Also take stock of your consumer debts – credit cards, personal loans, buy-now-pay-later schemes. This debt impacts you in a few ways: it soaks up a bunch of money you could be saving; it chokes your cashflow every time you get paid; and it could impact how much you can borrow if you’re looking at buying a first home. Not worth it right?

4. Get your foundations sorted

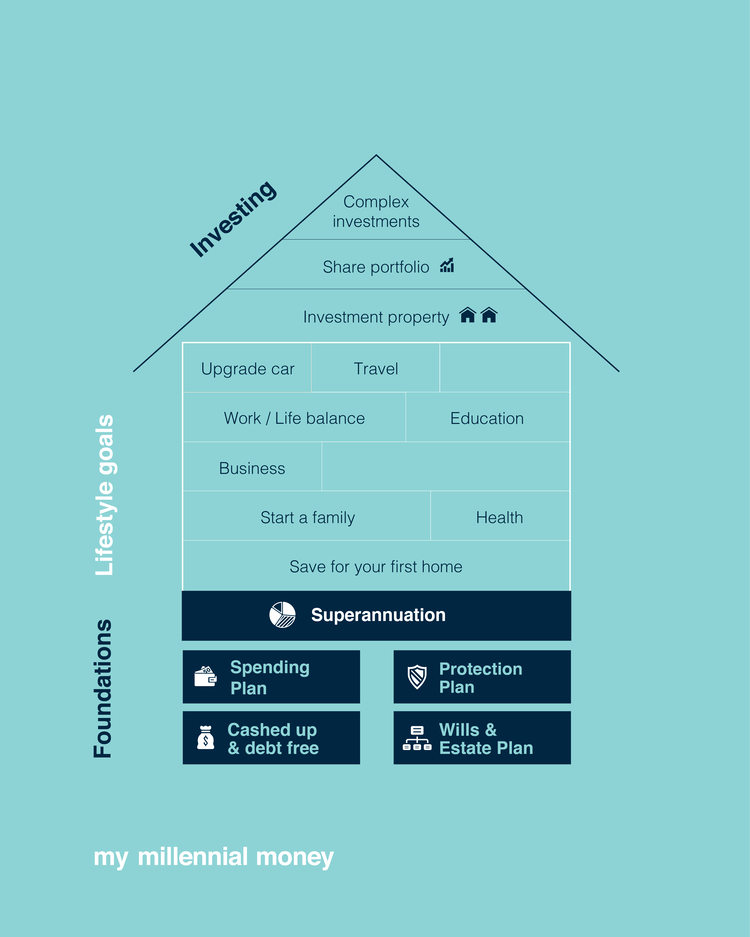

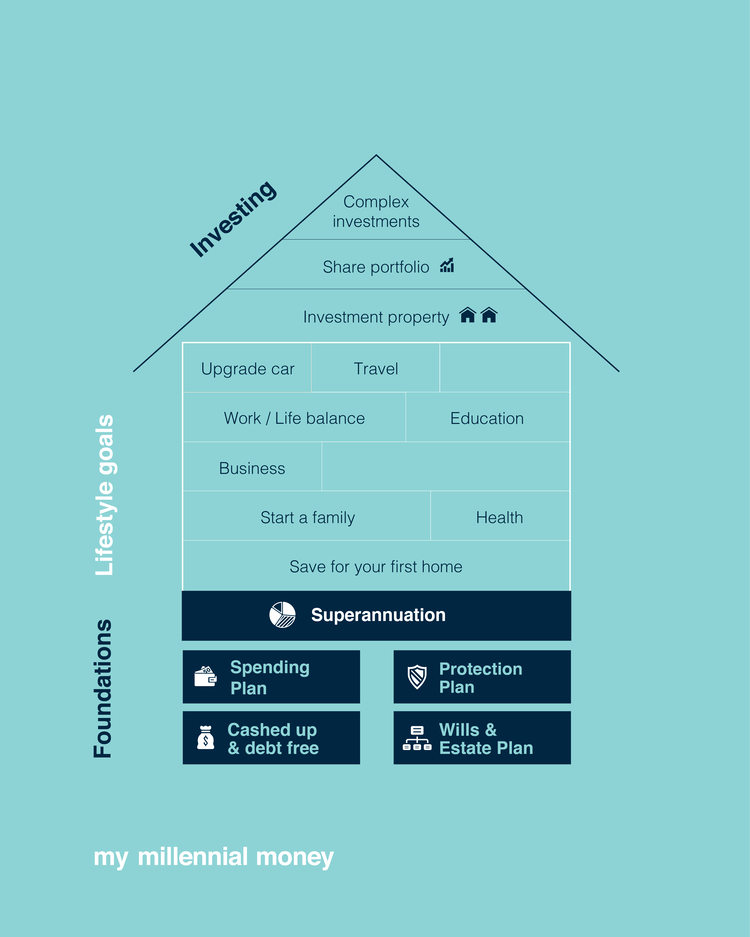

I’ve made this sound financial house diagram which shows you how you can set up your financial life. This is a handy guide for what areas to tick off your checklist when getting your financial foundations sorted.

Image: My Millennial Money

Start at the bottom and work your way up. Everyone’s story is different, so don’t worry if things have happened slightly out of order for you.

5. Invest for your future

If you do nothing else when managing money in your 30s, invest. Future You will thank you for the sweet favour. Somewhere that grows and in something you want to invest in. Choose investment areas that you like and that will grow overtime. So when you open them up in a few years, they’ve gained some weight. If you’re unsure about what investment options are available to you, start researching. Listen to podcasts, read blogs, read books, get informed and choose what you like. It might also suit you to talk to an independent financial adviser to figure out what’s best for you.

6. Knuckle down on your mortgage strategy

If you have a mortgage then make sure you’re prioritising it in your spending plan, and that you’re getting the best deal. Chat with a mortgage broker to make sure your deal is the best it can be. A mortgage is pretty big, so get it right! Also check out this tips for how to pay off your mortgage faster.

Read this too: Rent or buy: what’s the best strategy for young Australians?

7. Factor in family stuff

Having kids is a pretty decent financial responsibility. You might have kids already, you may be expecting a kiddo or you may hope to have children in the future. Whatever it is, you need to incorporate family planning and needs into your spending plan.

It’s not just things like buying a cot, toys and clothes. It’s also long term things like daycare and education, medical bills and insurances. You might need time out of the workforce to care for newborns or sick kids, so be prepared to tackle challenges like that.

Do your best to incorporate your goals into a broader goal plan for the whole family. Write a list together of what you’d like to achieve individually and together and set your course to those. These goals may shift, but you’ll be giving yourself and each member of your family the opportunity to share what they’re passionate about, and work together to achieve those goals.

8. Plan in fun stuff

Remember that European backpacking holiday you paid for using a credit card? Yeah those days can be done. Even if you’re just keen to have a weekend away somewhere nearby, save within your spending plan to pay for holidays like this with cash! Everyone needs a break to refresh and have some fun, so don’t apologise for prioritising whatever fun you want and can afford. Maybe you’re into painting, fishing, pottery, studying, reading, camping, collecting typewriters – who cares! It’s your life. You. Be. You.

More in this series:

- Top tips for managing money in your 20s

- Top tips for managing money in your 40s

- Top tips for managing money in your 50s

This is an edited version of an article that originally appeared on My Millennial Money. This article contains general information only. It should not be relied on as finance or tax advice. You should obtain specific, independent professional advice from a registered tax agent or financial adviser in relation to your particular circumstances and issues.

Trending

Sorry. No data so far.